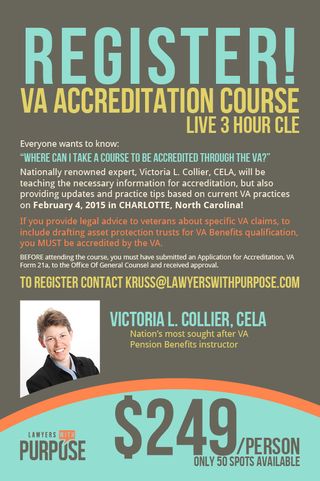

On Saturday, January 24, 2015 I received a text message from my employer, Victoria Collier. Though not unheard of, it was strange for her to text me on the weekend unless I had planned to work. However, she had been out of town on Thursday and Friday and I imagined that she wanted to get a head start on something for the coming week. Her text message simply read, “VA has issued the proposed look-back change in laws. Public comment period open 60 days.” By now you may know of RIN 2900-AO73, the proposed VA rules regarding net worth, asset transfers, and income exclusions for needs-based benefits and the potential impact that this will have for VA planning, found at www.regulations.gov. So as a paralegal, what did this mean to me? It had a lot to do with me.

In response to the proposed rule, the first step in the process was to discuss when and how this may affect our clients. The next action was to provide the attorney with an updated list of all of our pending VA claims – those we had filed fully developed claims or informal claims and those we had not yet filed anything with the VA – and especially to identify which of those involved transfers of assets as defined by the VA. Then we prioritized the claims that had not yet been filed and set a goal to file as many of those as we could by the end of February 2015, to lock in a March 1, 2015 eligibility date in an effort to beat any possible effective date of the rule changes.

In response to the proposed rule, the first step in the process was to discuss when and how this may affect our clients. The next action was to provide the attorney with an updated list of all of our pending VA claims – those we had filed fully developed claims or informal claims and those we had not yet filed anything with the VA – and especially to identify which of those involved transfers of assets as defined by the VA. Then we prioritized the claims that had not yet been filed and set a goal to file as many of those as we could by the end of February 2015, to lock in a March 1, 2015 eligibility date in an effort to beat any possible effective date of the rule changes.

The second step in our process was to inform our clients with pending VA claims of the proposed changes. While we could not provide them with definitive answers, we could assure them that we were aware of what was going on and that we would be doing our utmost to complete, file, and follow up with their claim in the face of this potential game-changer. This communication also enlisted our clients in actively participating in the process as it urged them to gather outstanding documents that we still needed to verify and file the claim as expeditiously as possible.

The final step was the actual completion of all the unfiled VA claims. This meant an incredible ramp up of our usual production, all while accepting new clients in the process. Whether it meant working directly on the claims themselves or supporting those producing the claims by assisting them with other tasks, the office as a team had to cooperate in order for the firm to produce this unusual volume of VA claims within a matter of 30 days.

Did we accomplish all of this just because of the proposed rule change? Yes and no. We definitely wanted to protect our clients in the best way possible, thus extra time was put in. However, because of the team atmosphere and the Lawyers with Purpose workflow systems, we were able to efficiently complete and file four times as many claims as usual in one month.

Whether the caseload is status-quo or there is a crisis situation, team members are always able to best support the attorneys and clients by:

- Staying flexible with priorities of tasks and files

- Sticking to the systems

- Maintain an overview status of all claims (globally and in detail)

- Ask questions when necessary and

- Anticipate the next action or step necessary and make efforts to complete.

In this way, not only do you support the attorney by thinking one step ahead of them, your questions also inform the attorney of possible gaps in your knowledge that require the attorney, in turn, to support the team with further training. Teams can accomplish nearly impossible feats when working together with the same goal.

If you are interested in learning more about Lawyers With Purpose, join our Having the Time To Have It All webinar on Monday at 8 EDT. Click here to register.

In this one hour webinar, you will learn how all entrepreneurs have the same amount of time in the day and how they use it differently.

Here's just some of what you'll discover in this practice-transforming event…

- How to effectively utilize your time to enroll your team to help as many people as you choose and profit from it too

- To work effectively with your team

- How to balance your work life and your personal life to ensure you are able to create the maximum amount of value in both

- How to have sufficient time to market consistently which will ensure consistent cash flow and free up the time you're currently spending chasing dollars

It will give you the confidence and path to create a law practice that provides estate planning, elder law, asset protection, Medicaid, veterans benefits, special needs, and tax planning in a way that helps your clients and your community!

Most importantly, you will be able to ensure your clients are able to maintain their dignity as they age and protect the assets they have worked their whole life for.

If you're passionate about helping people, reserve your space for this one hour webinar essential to help you break through your time restrictions to help more people and create more value!

Just register above to reserve your seat… it's 100% FREE!

By Sabrina A. Scott, Paralegal, The Elder & Disability Law Firm of Victoria L. Collier, PC and Production Coordinator for Lawyers for Wartime Veterans, LLC.