There's a constant battle between lawyers as to who should be trustee of an irrevocable asset protection trust. The primary school of thought is that it should never be the grantor, and some schools of thought believe it should never be the beneficiary. At Lawyers with Purpose, we disagree with both of those positions, but we recognize the concerns and rely on sound principles of asset protection law in making the final determinations.

Let's first discuss the question of whether the grantor should be trustee. Many practitioners believe that allowing the grantor to be trustee makes the assets of an irrevocable trust available to the grantor's creditors. Such a proposition is ludicrous. The challenge with most lawyers is that they do not allow the grantor to be trustee of his or her irrevocable trust. When pushed to explain why, they typically assume that's the way it was always done. Few dig further to see why it was done that way. So let's examine why grantors were not traditionally named trustee. The most adverse impact is that, if the grantor is trustee, they're deemed to retain enough control to have the assets of the trust included in their taxable estate when they die. For many generations, this was the death knell? of an asset protection trust. But in the last 15 years it's become irrelevant because of the rise of the estate tax exemption. Today only two in a thousand Americans have a taxable estate, so preventing the grantor from being trustee because of a potential inclusion of the trust asset in the estate of the grantor is not relevant to 99.8 percent of Americans. So why hold them to that standard?

Let's first discuss the question of whether the grantor should be trustee. Many practitioners believe that allowing the grantor to be trustee makes the assets of an irrevocable trust available to the grantor's creditors. Such a proposition is ludicrous. The challenge with most lawyers is that they do not allow the grantor to be trustee of his or her irrevocable trust. When pushed to explain why, they typically assume that's the way it was always done. Few dig further to see why it was done that way. So let's examine why grantors were not traditionally named trustee. The most adverse impact is that, if the grantor is trustee, they're deemed to retain enough control to have the assets of the trust included in their taxable estate when they die. For many generations, this was the death knell? of an asset protection trust. But in the last 15 years it's become irrelevant because of the rise of the estate tax exemption. Today only two in a thousand Americans have a taxable estate, so preventing the grantor from being trustee because of a potential inclusion of the trust asset in the estate of the grantor is not relevant to 99.8 percent of Americans. So why hold them to that standard?

The next major argument is a theory that if the grantor has control of the trust, then he could direct it back to himself. Well, that depends. What does the trust say? If the trust says that the grantor is not a beneficiary, or similarly the grantor is not a principal beneficiary but is entitled to the income, does that mean that the grantor as trustee all of a sudden gains a super power to violate the terms of the trust and give himself the principal when it's not allowed for? Hardly. In fact, there is consistent case law throughout all of the states, including cases that lead all the way up to the Supreme Court, that supports the notion that a grantor as trustee has all of the same fiduciary obligations as any other trustee and by no means has authority to act outside the powers granted to trustee. I specifically refer you to my Law Review article, "The Irrevocable Pure Grantor Trust: The Estate Planning Landscape Has Changed" in the Syracuse Law Review. In this article, I go through in‑depth review of all of the case law nationwide, and I'm excited to say that it is sound law that a grantor can be a trustee without risking the assets to the creditors of the grantor. One caveat, however, is if the grantor does retain the right to the income, then absolutely the income will be available to the creditors of the grantor.

So are there circumstances when the grantor as trustee's trust is invaded? Absolutely, but in every single case the invasion was not due to the grantor being the trustee, but rather was due to the pattern of behavior by a grantor trustee who violated regularly the terms of the trust in favor of themselves, and the trust was thereafter deemed a sham. In such cases, I concur with any court that makes that decision based on people who try to defraud the system. Irrevocable trusts must be managed in an arm's length manner, and as lawyers we do not plan for someone to become fraudulent. They are fraudulent to their own peril. But a properly drawn trust when the trustee is the grantor in no way, shape or form creates any risk of loss of asset protection if the terms of the trust are followed, as they are required to be in every case whether the grantor is trustee or not.

So at Lawyers with Purpose we encourage our members to do good legal work based on sound law, not fear, conjecture or because that's the way it's always been done. In the end, the client wins. It is silly to deny thousands of clients that we serve the ability to manage and control their own assets for the benefit of their families, just because some rogue case in some rogue state from some vile fact pattern allowed the court to invade against the intentions of the grantor. Protect your clients. Teach your clients. Share with your clients how these work. They are very safe and a great planning tool.

If you want to learn more about Lawyers With Purpose you can find all the information about becoming a member by clicking here to download our Membership Brochure.

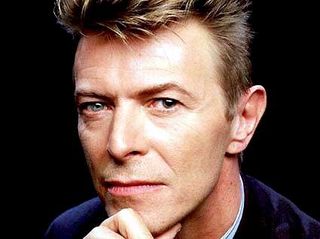

David J. Zumpano, Esq, CPA, Co-founder Lawyers With Purpose, Founder and Senior Partner of Estate Planning Law Center